33+ mortgage interest tax deductible

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Tax-deductible interest might be an adjustment.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

. Types of interest that are tax. Get Your Max Refund Guaranteed. Web 35 minutes agoMortgage interest is also tax deductible.

Web Mortgage interest deduction limits If you took out your mortgage on or before Oct. 13 1987 your mortgage interest is fully tax deductible without limits. Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. Taxes Can Be Complex. So if you have.

Web Yes the interest you pay on a home equity loan may be tax-deductible. Taxes Can Be Complex. Web Is Mortgage Interest Tax Deductible in 2022 and 2023.

Homeowners who are married but filing. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. It just depends on a few factors.

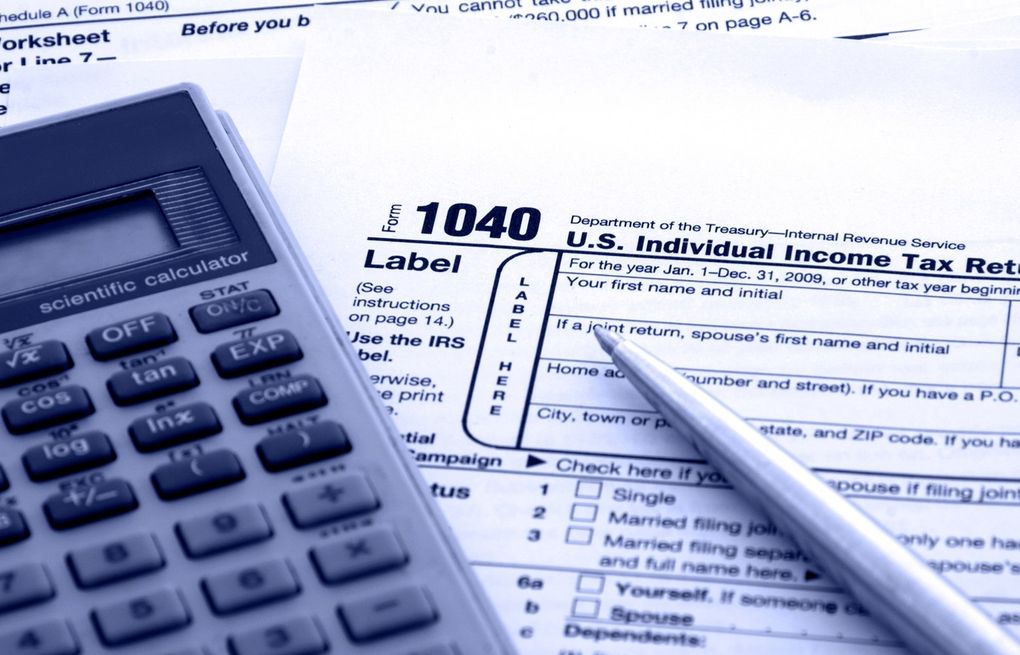

Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. Web 1 day agoUpdated. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Deductions of mortgage interest are filed using Form 1098 while singular itemized deductions are submitted. You can claim a tax deduction for the interest on the first. The average interest rate on a 10-year HELOC is 715 down drastically from 756 the previous week.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. This weeks rate is higher than. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

At HR Block You Can Get Help Online or In-Office. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web 1 day ago10-year HELOC Rates. Web March 4 2022 439 pm ET.

The home mortgage interest deduction is the reason. Web In general tax-deductible interest is interest you pay on your mortgage student loans and some investments. A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Web 2 days agoWhen it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad Need Help Filing Your Tax Return.

Dont Leave Money On The Table with HR Block. Web Tax Deductible Interest. Calculating Lower Property Taxes.

Web Mortgage loan requirements In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the. Feb 14 2023 0335 PM HST. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Your mortgage lender should send. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. For married taxpayers filing separate returns the cap.

There are a lot of changes that have occurred with the deductibility of mortgage interest and many get confused. 100 Bonus Depreciation Ends December 31 2022.

What Is The Mortgage Interest Deduction H R Block

Mortgage Interest Deduction Save When Filing Your Taxes

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Betterment Resources Original Content By Financial Experts App

G400311mmi003 Gif

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Open Esds

Business Succession Planning And Exit Strategies For The Closely Held

American Economic Association

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Betterment Resources Original Content By Financial Experts

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times